M&A (mergers and acquisitions) has become popular in recent years as a management option and a means of business succession, and is reported in newspapers and magazines on a daily basis. The number of specialists who support them has been increasing, and it is thought that the environment that facilitates M&A has become much more favorable in recent years. However, in reality, there may be many cases in which it is difficult to know which specialist to ask in which situation.

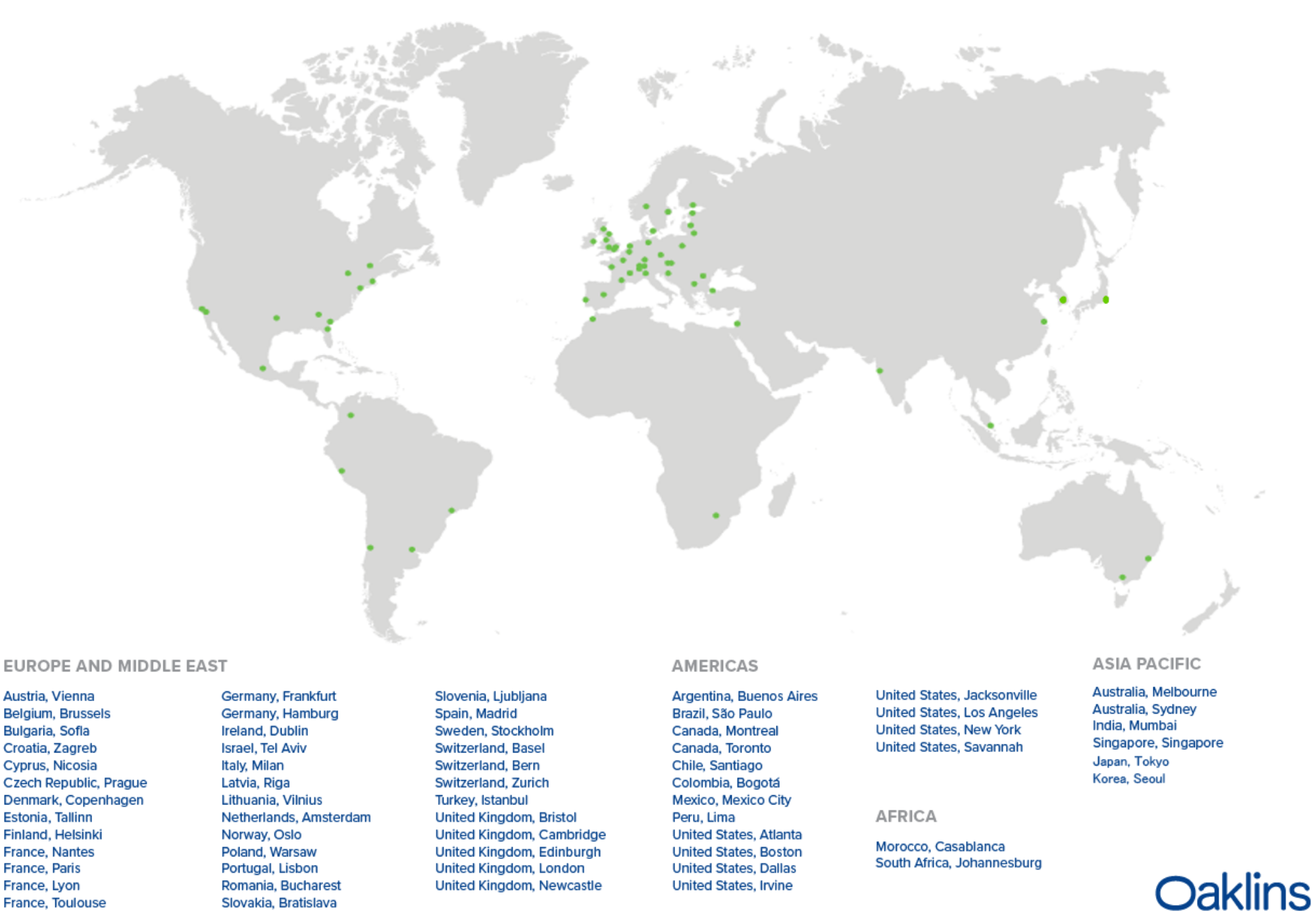

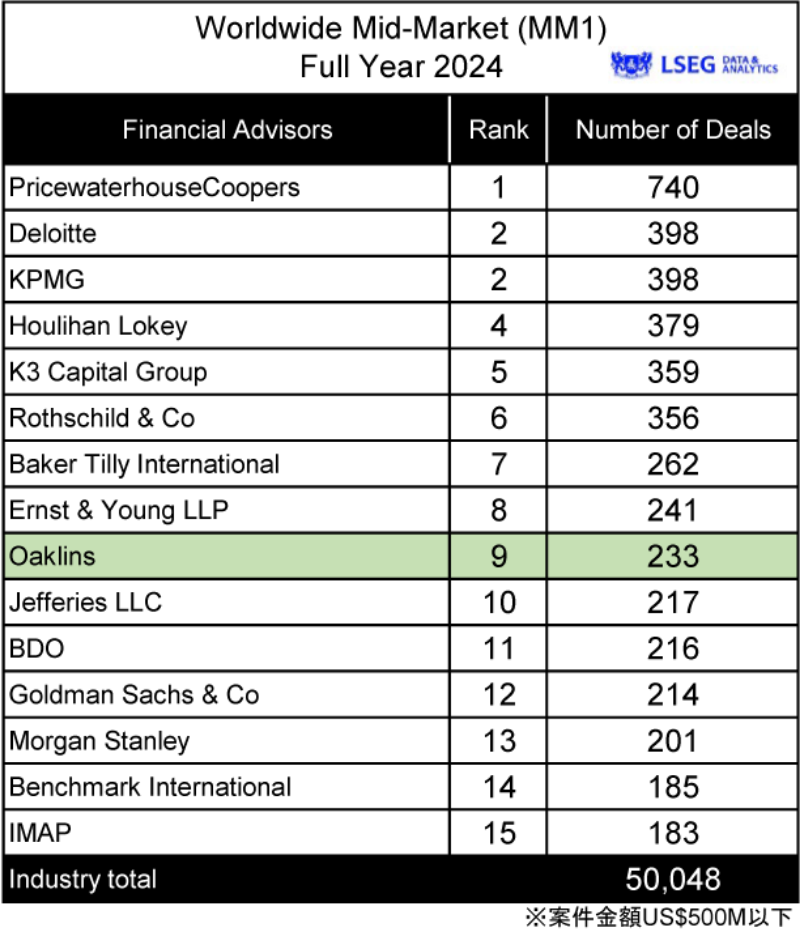

Professionals who support M&A transactions are called "M&A advisors" or "financial advisors (FA)." There are different types of M&A advisors, and their areas of expertise vary depending on the characteristics of the deal. Large domestic and foreign securities firms, major banks, and major independent advisory firms specialize in large-scale cross-border transactions and large-scale restructuring projects. On the other hand, M&A brokerage firms, which have been on the rise recently, specialize in matching (brokerage) business between small and medium-sized companies. Meanwhile, there are not many firms that specialize in mid-size deals.

In Japan, the number of M&A brokerage firms is rapidly increasing due to the growing need for business succession. The problem of structural conflicts of interest in the brokerage business, in which the broker receives compensation from both the seller and the buyer ("two-sided brokerage"), should be kept in mind. In other words, in M&A, both the seller and the buyer have needs to close the deal on favorable terms, including price, and it is structurally impossible to advise both parties. It is normal for a seller to want to sell at a high price and a buyer to want to buy at a low price. In M&A, property details and contract terms are not uniform as in real estate transactions, so it is impossible to advise both the seller and the buyer in negotiating M&A terms and conditions. When seeking financial advisory services from brokerage firms, it is necessary to understand the structural issues involved.

With this in mind, our firm, Maxus Corporate Advisory, was created to provide comprehensive support for mid-size M&A transactions.

We are committed to providing our clients with the highest level of M&A advisory skills and services, even for mid-size deals. By sharing our wealth of experience not only in large transactions, but also in mid-size transactions, we at Maxus Corporate Advisory hope to contribute to the growth and development of companies and the success of as many M&A transactions as possible.